idaho solar tax credit 2021

Its not available if you lease the system. The first year after installing your home PV system the Idaho solar tax credit allows you to deduct 40 percent of the cost of your photovoltaic power project when you file income taxes.

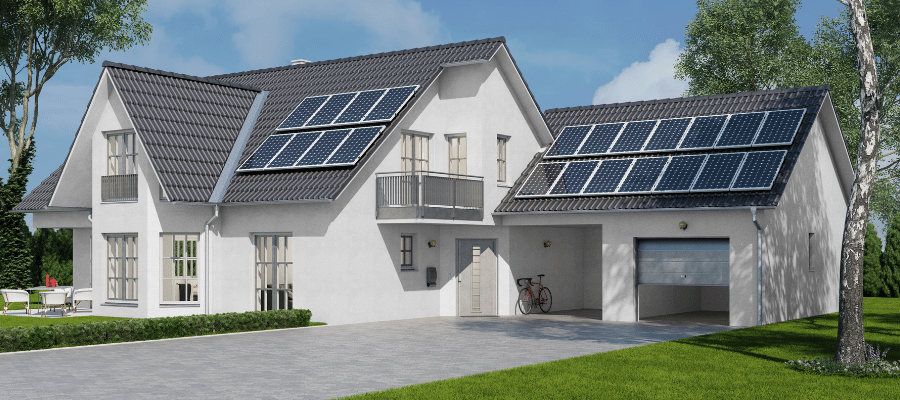

Solar Panels For Idaho Homes Tax Incentives Prices Savings

For most homeowners this effectively translates to a 26 discount on your home solar system.

. Deduction for alternative energy device at residence. 1 An individual taxpayer who installs an alternative energy device to serve a place of residence of the individual taxpayer in the state of Idaho may deduct from taxable income the following amounts actually paid or accrued by the individual taxpayer. Idaho law also allows for solar easements.

You filed as Married Filing Joint in 2020 but filed as Single or Head of Household in 2021. For example claiming a 1000 federal tax credit reduces your federal income taxes due by 10001 What is the federal solar tax credit. Intermountain Gas Company IGC - Energy Efficiency Rebate Program.

Idaho taxpayers whove suffered a disaster loss in Benewah Bonner Kootenai and Shoshone counties because of straight-line winds on January 13 2021 can report the loss amount on Idaho Form 39R. My address has changed since I filed my 2021 tax return. Keep in mind that the ITC applies only to those who buy their PV system outright either with a cash purchase or solar loan and that you must have enough.

Its capped at 5000 per year or 20000 total whichever comes first. Federal Renewable Production Tax Credit for Land-Based Wind. This incentive reimburses 25 of your system cost up to 1600 off of your personal income tax Learn More.

Projects that begin construction in 2021 and 2022 are eligible for the 26 federal tax credit while projects that begin construction in 2023 are eligible for a 22 tax credit. Loans are leveraged by utility incentives as well as federal and state tax credits and deductions. If you are residential or commercial property owner or manager you may be eligible for a tax credit to install Solar Electric Systems up to 25000.

The tax credit does not apply to. See how much you can save on home solar panels through rebates tax credits in Idaho. In 2021 the ITC will provide a 26 tax credit on your solar panel installation costs provided that your taxable income is greater than the credit itself.

Wind projects started in either 2020 or 2021 will qualify for a production tax credit at 60 of the full rate on the electrical output for 10 years. Heres the full list of federal state and utility incentives that apply where you live. To see where Idahos solar farms are located.

In Idaho you can claim up to 1000 in tax credits for switching to solar energy. Electricty Kilowatt Hour Tax. As of May 2022 the average solar panel cost in Idaho is 275WGiven a solar panel system size of 5 kilowatts kW an average solar installation in Idaho ranges in cost from 11688 to 15812 with the average gross price for solar in Idaho coming in at 13750After accounting for the 26 Federal Investment Tax Credit ITC and other state and local solar.

Idaho has lots of sunshine and a few laws that are favorable for solar power and renewable energy. Instead of a more straightforward tax credit for installing solar Idaho decided to enact a 100 tax deduction. Any insulation added must be in addition to.

Similar to laws in other states Idahos solar easement provision does not create an automatic right to sunlight. Fuels Taxes and Fees. This credit currently amounts to 26 of your solar systems cost.

The federal residential solar energy credit is a tax credit that can be. In addition to the federal tax credit Idaho provides a state tax deduction worth 40 of your total solar power system cost for the first year after installation. ITC for solar is a tax credit that can be claimed on the federal income taxes of individuals or corporations for a portion of the cost of installing.

According to the Idaho Department of Energy. Box 70 Boise ID 83707 Idaho Power Payment Processing PO. For federal purposes taxpayers can increase their standard.

There will be no credit for small-scale solar by 2024. Solar power projects which would have expired in 2020 will now remain at 26 for projects that begin construction in 2021 and 2022 be. So if your system costs 20000 the ITC would enable you to claim around 5200 as a credit on.

In addition the Federal Government offers a 30 tax credit for the whole installed cost of your system Thats a huge benefit available to you no matter where you live in the US. Idaho solar tax credit 2021. Idahos solar tax credit is one of the best in the nation benefiting even those who have very little of their own.

Customer Service Treasure Valley. Your rebate will be based on the 2020 return but youll receive only half of the rebate amount. In 2023 the tax credits for installations will drop to 22.

Box 5381 Carol Stream IL 60197-5381. So when you go solar you can take 40 of your installation cost as a deduction in the first year up to a maximum of 5000. With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percent.

Go to line 23 Other Subtractions and provide an explanation of the subtraction. It will be split equally between you and your ex-spouse following Idaho Community Property law 32-906. Then for the next three years youll be eligible for a 20 percent state income tax deduction.

E911 - Prepaid Wireless Fee. Each year the maximum deduction is 5000. Forty percent 40 of the amount that is properly attributable to the.

Talk to a local installer about the incentives available in your area. These are the solar rebates and solar tax credits currently available in Idaho according to the Database of State Incentives for Renewable Energy website. What is a tax credit.

Updated March 7 2021 Idaho State Tax Credit. A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. ITC is available to Idaho homeowners who purchase their solar panel system with cash or a loan.

Then for the next 3 years you can deduct 20 of the cost each year from your state income for tax purposes. Idaho residents with homes built or under construction before 2002 or who had a building permit issued before January 1 2002 qualify for an income tax deduction for 100 of the cost of installing new insulation or other approved energy efficiency improvements in an existing residence. The federal solar tax credit.

The ITC for solar power projects which would have expired in 2020 will now remain at 26 for projects that begin construction in 2021 and 2022 be reduced to 22 in 2023 and decrease to 10 in 2024 for commercial size projects. 2 Additional credits apply at 20 of the total system cost per year for three years thereafter. Dont forget about federal solar incentives.

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

Federal Solar Tax Credit For Residential Solar Energy

A Colorado Steel Mill Is Now The World S First To Run Almost Entirely On Solar

When Does The Federal Solar Tax Credit Expire Iws

Idaho Solar Incentives Creative Energies Solar

Federal Solar Tax Credit For Residential Solar Energy

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

The Solar Tax Credit Explained 2022 Youtube

How Does The Solar Tax Credit Work In Idaho Iws

How To Get A Solar Farm On Your Land Verogy

How Does The Solar Tax Credit Work In Idaho Iws

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

Team Motivation Horizonpwr Team Motivation Solar Energy Facts Motivation

Fact Vs Myth Can Solar Energy Really Power An Entire House 2021 Update Bluesel Home Solar

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

How Does The Solar Tax Credit Work In Idaho Iws

Solar Panels For Idaho Homes Tax Incentives Prices Savings

Ability To Respond Horizonpwr Solar Solar Energy Facts Fastest Growing Industries Solar Panel Installation

Build Skill And Embrace Challenge Horizonpwr Solar Solar Energy Facts Find A Career Above The Line